A Newbie's Overview to Hard Money Lenders in Georgia Atlanta and Their Advantages

A Newbie's Overview to Hard Money Lenders in Georgia Atlanta and Their Advantages

Blog Article

Exploring the Influence of Money Lenders on Regional Economic Situations and Small Companies

The impact of cash lenders on tiny services and local economies warrants mindful evaluation, as their duty extends beyond simple economic deals. By offering accessible credit history to entrepreneurs who might be marginalized by traditional financial systems, these lenders can drive advancement and economic vigor.

Duty of Money Lenders

In numerous neighborhoods, the function of cash lenders prolongs past simple monetary transactions; they function as crucial agents in the neighborhood economic climate. Cash lenders supply crucial credit report to people and services that might not have accessibility to traditional banking services. By offering car loans, they assist in usage, making it possible for families to buy products and solutions that enhance their high quality of life. This instant access to funds can be vital in times of economic distress or when unanticipated expenditures develop.

Moreover, money lending institutions frequently possess a deep understanding of the local market, which allows them to customize their solutions to meet the details requirements of their clients. This local understanding fosters trust fund and builds connections, urging debtors to participate in efficient economic tasks. The infusion of resources from cash lenders can boost entrepreneurship, as aspiring entrepreneur utilize fundings to begin or broaden their ventures.

In addition, money loan providers contribute to economic addition by offering underserved populaces, thus advertising financial diversity. Their operations can boost liquidity in the neighborhood, bring about enhanced financial activity and growth. Inevitably, cash lenders play an essential function in maintaining the financial material of their communities.

Benefits for Local Business

Countless local business count on cash loan providers for crucial financial support that can drive their growth and sustainability - hard money lenders in georgia atlanta. Accessibility to funds makes it possible for these enterprises to invest in important sources, consisting of advertising, inventory, and equipment initiatives. This economic increase can substantially enhance operational abilities, allowing businesses to satisfy customer demands more properly and expand their market reach

Moreover, cash lenders typically supply quicker accessibility to capital compared to conventional banks, which can be important for small services dealing with urgent financial demands. This dexterity enables entrepreneurs to confiscate possibilities, such as limited-time promos or seasonal sales, which can reinforce revenue.

Additionally, money lending institutions may offer flexible payment options customized to the distinct cash money circulation patterns of local business. hard money lenders in georgia atlanta. This adaptability guarantees that entrepreneur can manage their financial resources without jeopardizing their operational stability

Furthermore, the partnership with cash lenders can promote a sense of count on and community assistance, as local loan providers frequently understand the certain challenges little businesses encounter. By offering not simply moneying but additionally assistance, cash lenders can play a critical role in enhancing neighborhood economic situations, ultimately adding to work creation and neighborhood growth.

Obstacles and risks

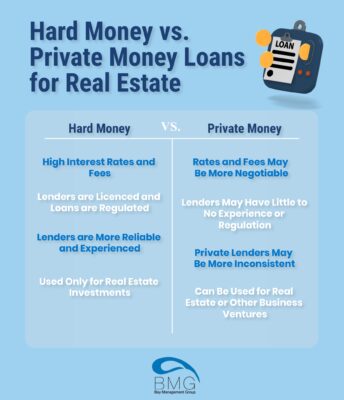

While cash loan providers can use substantial advantages to small companies, there are inherent dangers and difficulties related to counting on their services. One main worry is the potential for excessively high interest rates, which can result in unrestrainable debt levels. Local business, currently running on slim margins, might discover themselves entraped in a cycle of obtaining to repay existing lendings, ultimately hurting their economic wellness.

Furthermore, the absence of guideline in some lending practices elevates the threat of predacious financing. Dishonest loan providers may make use of prone entrepreneurs, providing financings with covert fees and negative terms that can jeopardize the stability of the company. This circumstance can cause a loss of count on the economic system, discouraging accountable borrowing.

An additional challenge is the pressure to fulfill payment schedules, which can strain a service's cash circulation. If unforeseen expenses arise or sales decrease, companies might struggle to make timely settlements, potentially causing further financial distress or insolvency.

Furthermore, the dependence on short-term car loans check can divert focus from long-term tactical planning, stifling development opportunities. Generally, while money lending institutions can work as an essential source, their usage must be approached with care to alleviate these inherent threats.

Neighborhood Growth Impact

The influence of money loan providers on neighborhood development can be extensive, particularly in underserved areas where accessibility to traditional financial services is limited. By giving crucial financial solutions, these lending institutions often fill up an important gap, making it possible for individuals and local business to access capital that may otherwise be unattainable. This increase of financing can promote local economic climates by promoting business development, job development, and raised customer spending.

Moreover, cash lending institutions can contribute to community growth by sustaining business that site endeavors that promote advancement and variety within the neighborhood industry. Small companies typically act as engines of economic growth, and when they get funding, they can improve their offerings and employ neighborhood residents. Additionally, the presence of cash loan providers may encourage the facility of neighborhood collaborations and networks, fostering a collaborative environment that can result in additional financial investment in neighborhood jobs.

Nevertheless, it is important to balance the benefits with responsible borrowing practices. Predatory lending can threaten neighborhood advancement, causing cycles of financial obligation that hinder financial progress. Thus, while cash loan providers can play a critical function in community development, their techniques should be scrutinized to ensure they add positively to the neighborhood economic situation.

Future Trends in Borrowing

Shifting and arising innovations consumer expectations are positioned to reshape the future of lending significantly. The assimilation of expert system and artificial intelligence will certainly enhance risk assessment designs, enabling loan providers to make even more educated choices quickly. These modern technologies can evaluate large datasets to identify patterns and anticipate consumer actions, thus decreasing default prices and improving funding performance.

Furthermore, the increase of fintech business is driving boosted competitors in the financing landscape. These active companies often supply much more versatile terms and quicker authorization procedures than typical financial institutions, pop over to this web-site attracting more youthful customers that value benefit. As an outcome, traditional lenders may require to innovate their services or risk losing market share.

Additionally, the expanding focus on sustainability is affecting offering techniques - hard money lenders in georgia atlanta. A lot more lending institutions are most likely to include ecological, social, and governance (ESG) requirements right into their loaning decisions, promoting responsible borrowing and financial investment

Final Thought

To conclude, cash lenders work as vital facilitators of credit within regional economic climates, especially benefiting small companies that encounter obstacles to conventional funding. While their contributions promote entrepreneurial development and job development, the associated dangers of high rate of interest and possible predatory methods necessitate mindful policy. Making certain accountable financing methods is necessary for taking full advantage of favorable area development results. The future of borrowing will likely entail innovative remedies that balance access with sustainability, cultivating economic resilience in underserved locations.

The impact of cash loan providers on tiny services and neighborhood economic situations warrants mindful assessment, as their role extends past simple monetary deals. Money lending institutions give important credit score to people and companies that may not have accessibility to traditional financial services.Numerous tiny companies depend on money lending institutions for vital financial support that can drive their growth and sustainability.While cash loan providers can offer considerable advantages to small services, there are fundamental threats and challenges linked with relying on their solutions.In conclusion, cash loan providers serve as essential facilitators of credit score within regional economic climates, particularly profiting tiny services that face obstacles to typical financing.

Report this page